Configuring QuickBooks

Steps to follow

Configuring refresh and access tokens

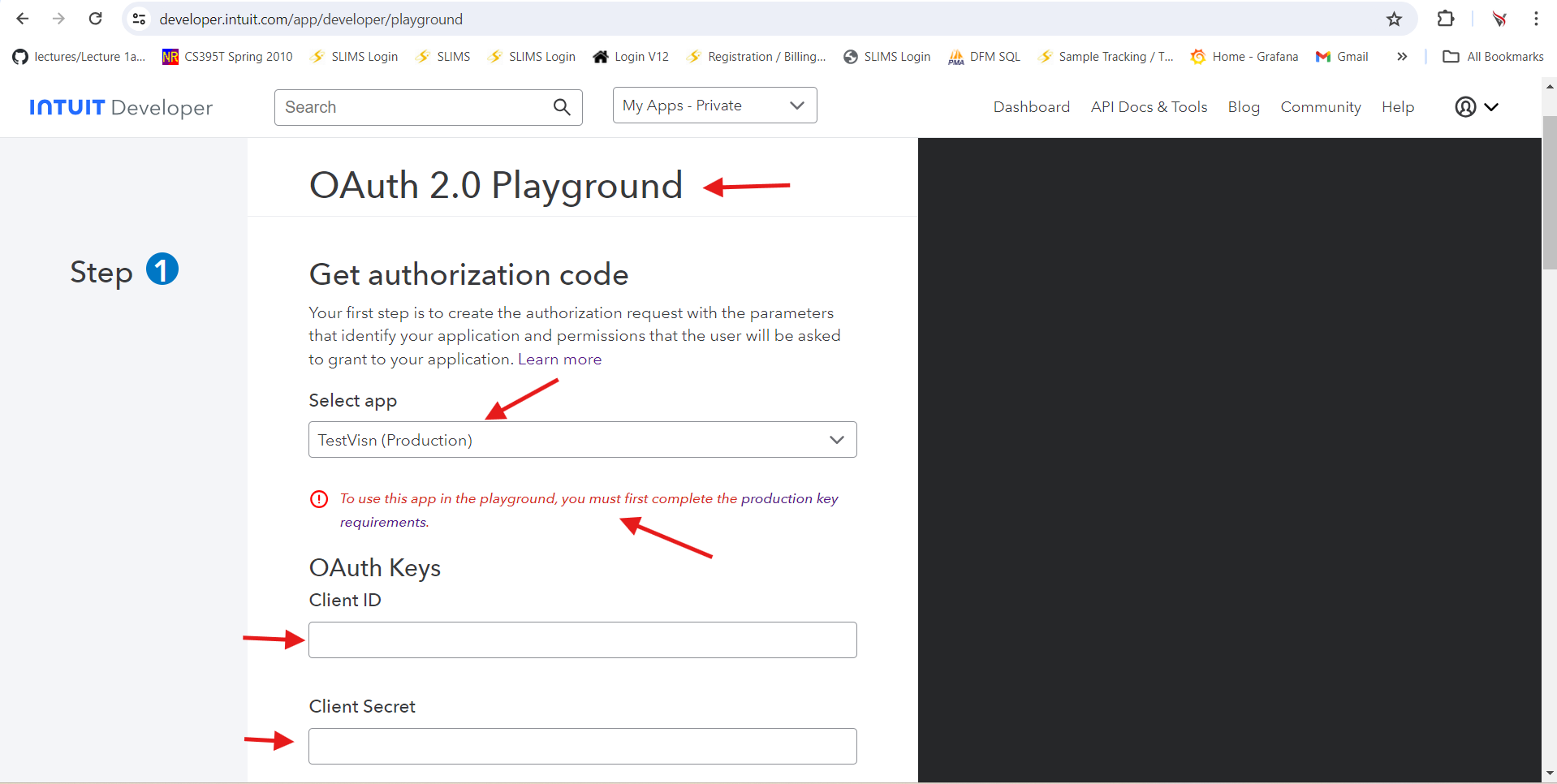

We need refresh token and access token to use quickbooks apis. To Get Refresh token and access token we need to use quickbooks oauth playground. Link -> https://developer.intuit.com/app/developer/playground

-

Chose your application from the select app dropdown.

-

Finish the production key requirements( to get the production clientId and client secret).

-

After getting the keys enter them in the oAuth keys section.

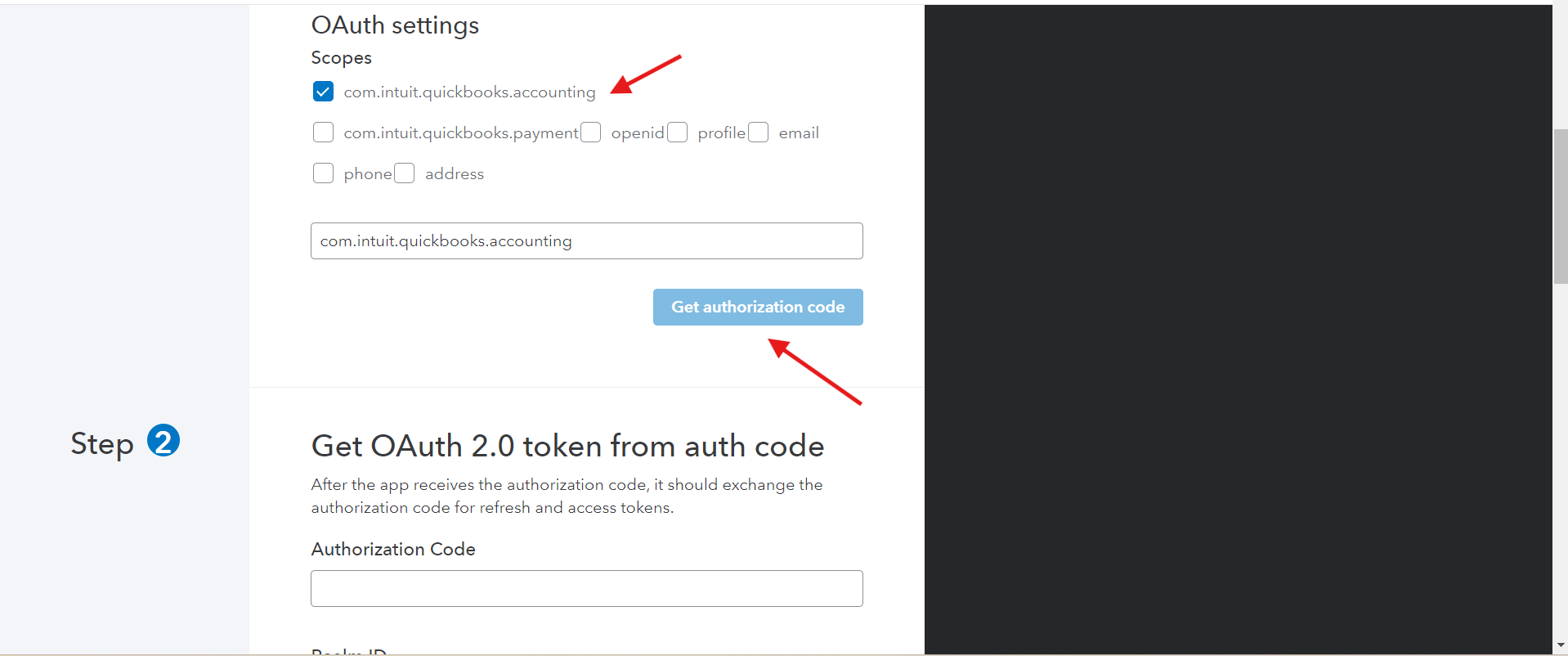

- Choose com.intuit.quickbooks.accounting option in the scopes section and click Get authorisation code button.

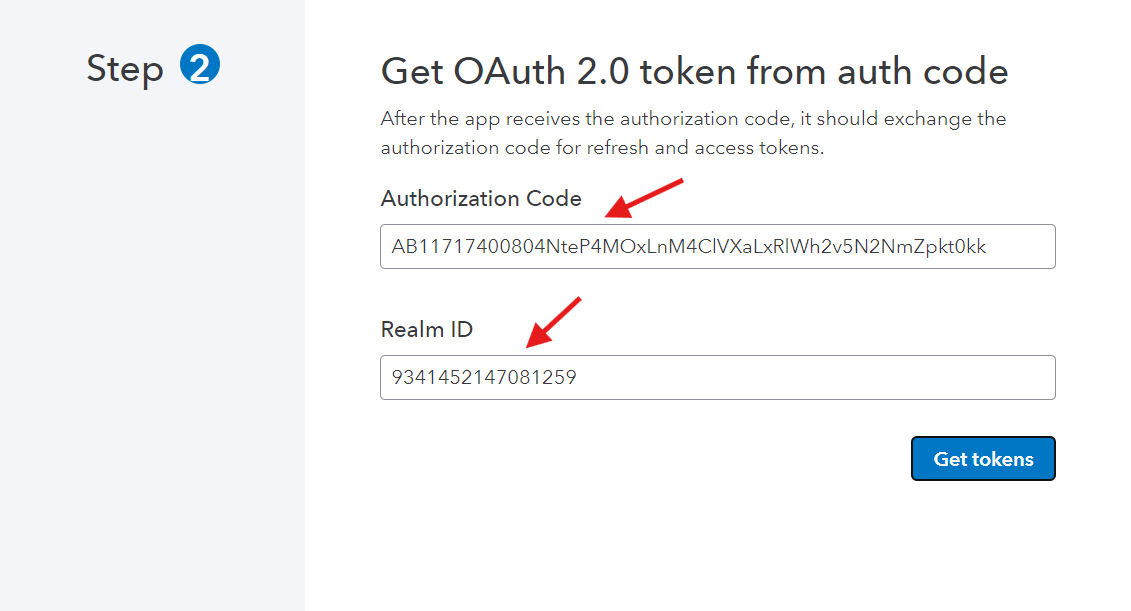

- After clicking this button. The Auth code and realm Id would be pre populated automatically. Click the Get Tokens button.

-

You can ignore the make API calls step as it is optional.

-

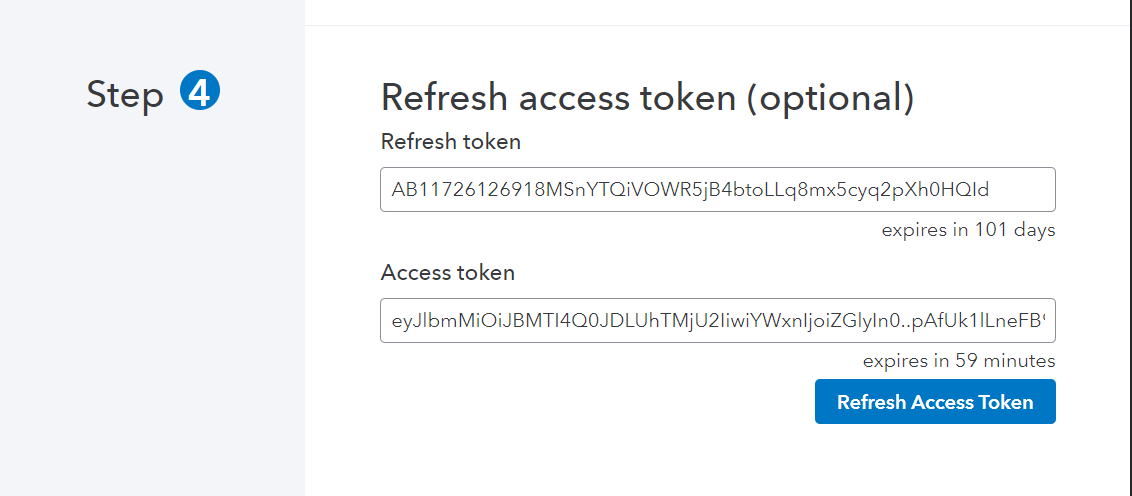

After clicking the Get tokens button. you'll be able to see the Refresh token and access token.

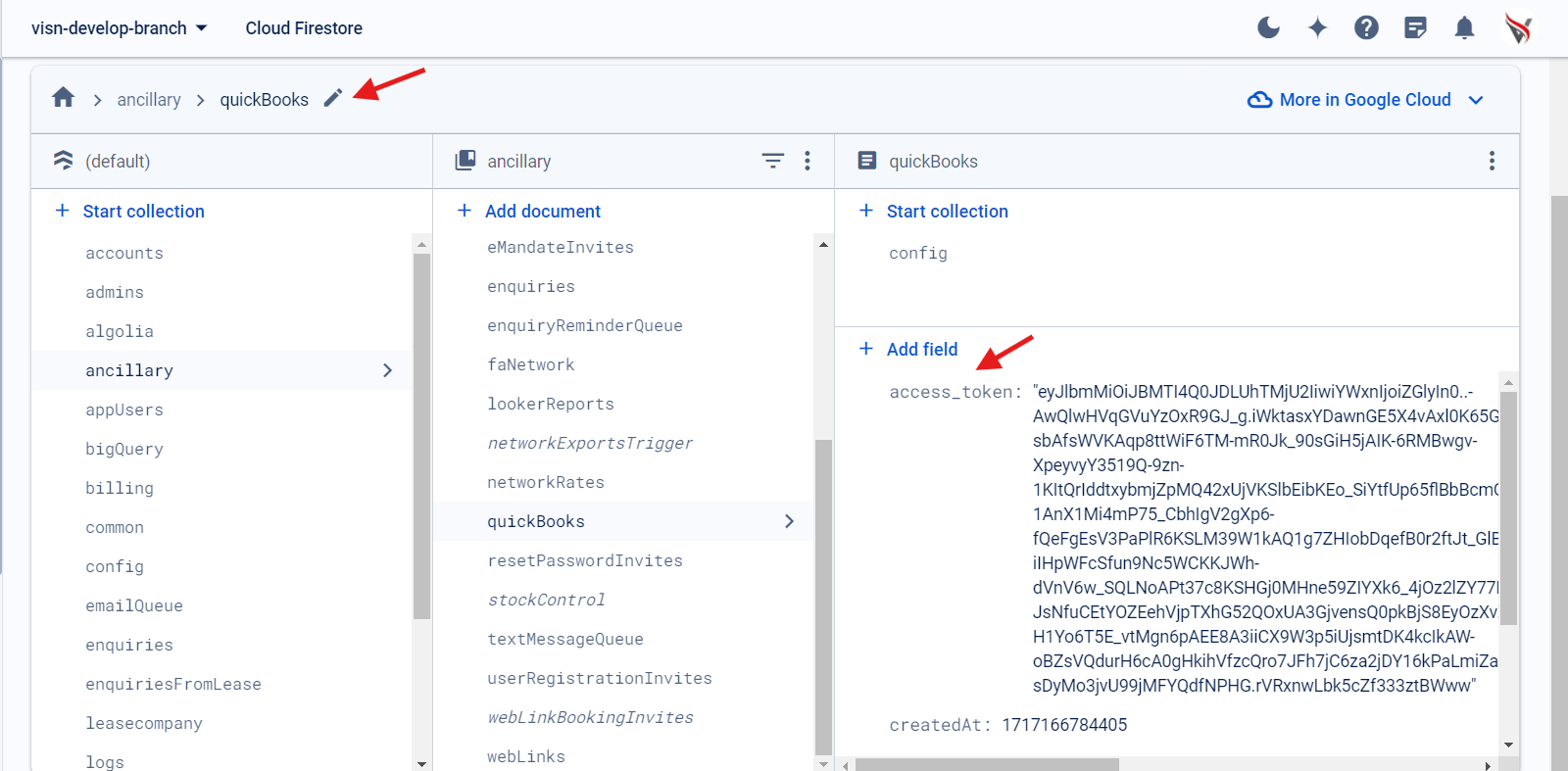

- Go to firebase. In the ancillary collection create document quickBooks and add the access token and refresh token. The field names should be access_token and refresh_token.

Configuring Vat Rates

-

Follow these steps to use quickbooks APIs using postman. Link -> https://developer.intuit.com/app/developer/qbo/docs/develop/sandboxes/postman

-

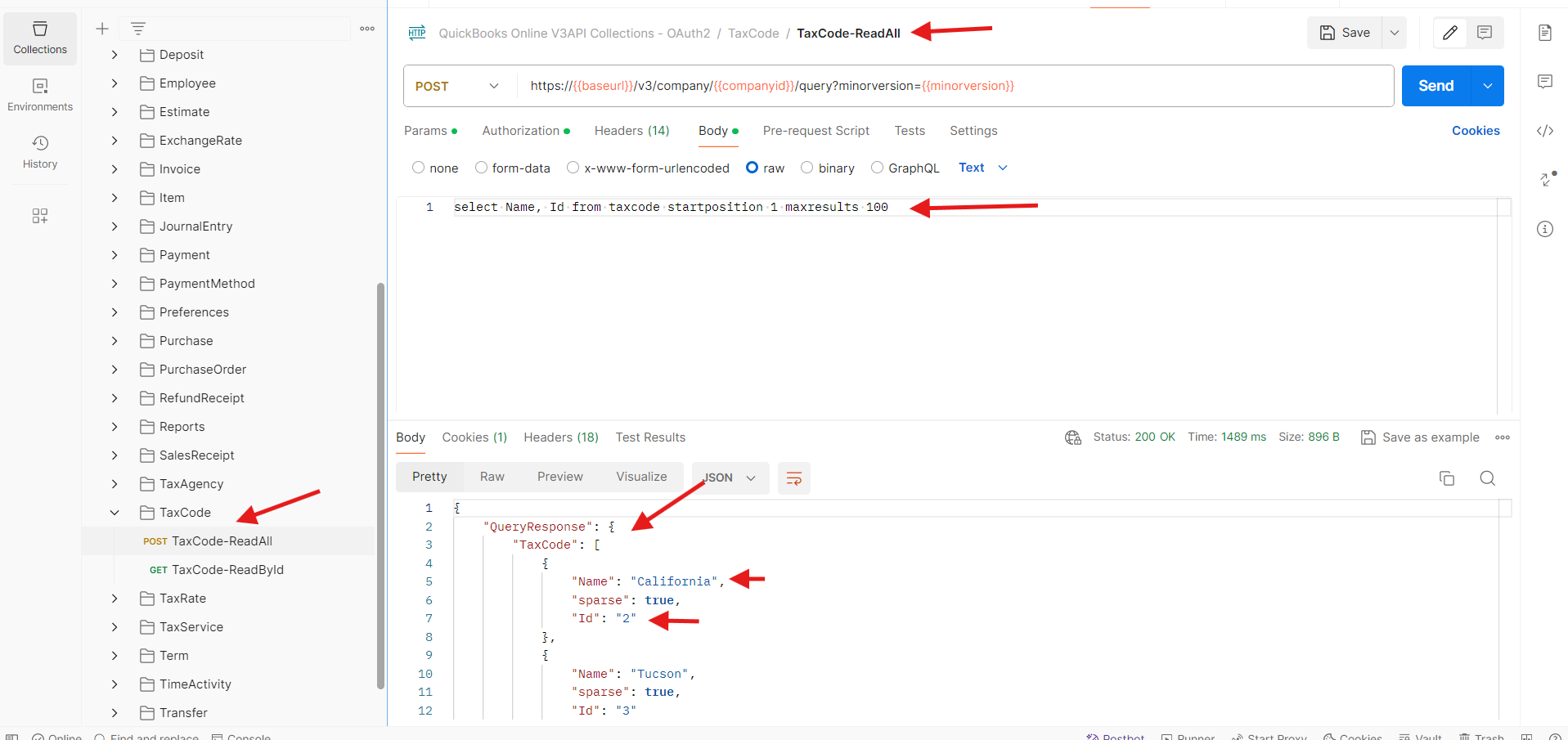

Once the configuration is done. Run Tax code Read All Api from the collection and we'll get a response.

-

In our application we have vat Rates. STANDARD - 20, REDUCED RATE - 5%, ZERO RATE - 0, OUT OF SCOPE - 0% and EXEMPT - 0% for uk companies. In the json response we have to search for these vat Rates and get their ids. The name field in the response in the name of the vat rate and id field will have the corresponding id.

-

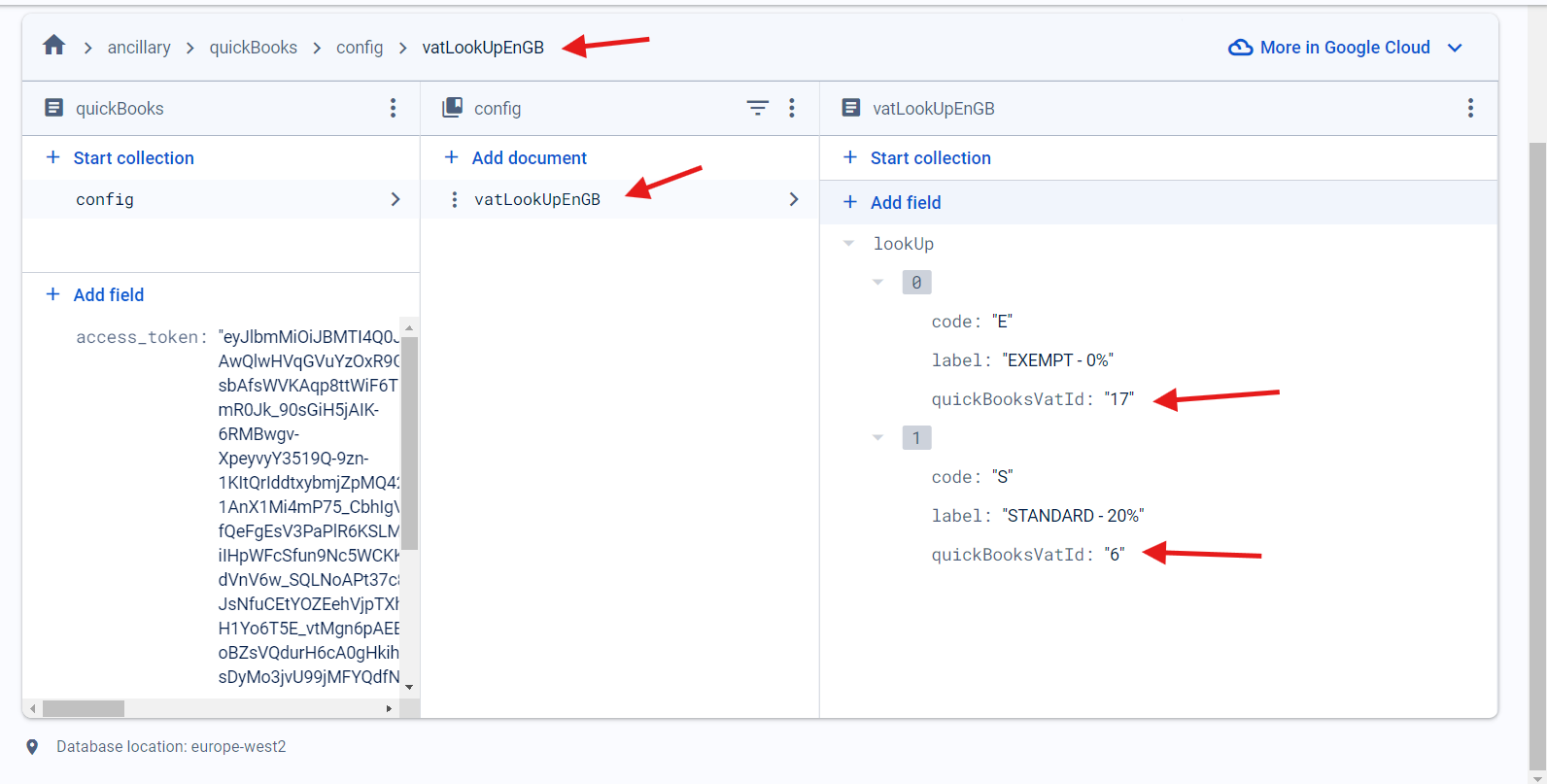

Once the ids are obtained we need to add those ids in our vat look up configuration in firebase. Document path -> /ancillary/quickBooks/config/vatLookUpEnGB

- The tax codes will not have the same name in quick books and in our application. For example STANDARD -20% in our application will be S-20% in quick books. We have to get the id for S-20% from the json response and add it as quickBooksVatId for STANDARD 20% in firebase. The vat rates for Ireland are not yet configured. Once they are set up in quick books we have to follow the same method and add the vat Rates in vatLookUpEnIE for Ireland companies.

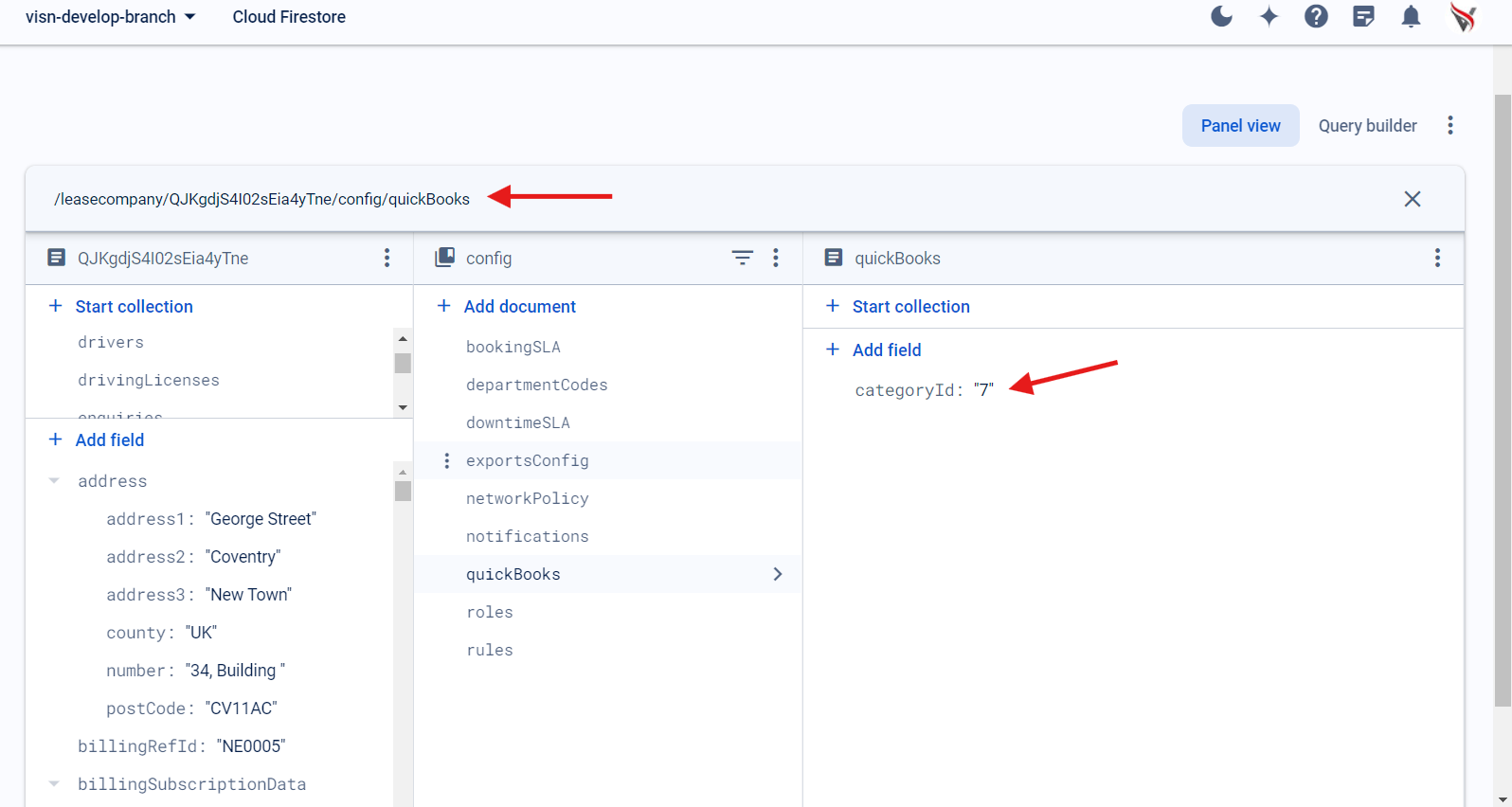

Configuring Category Id for lease Companies.

-

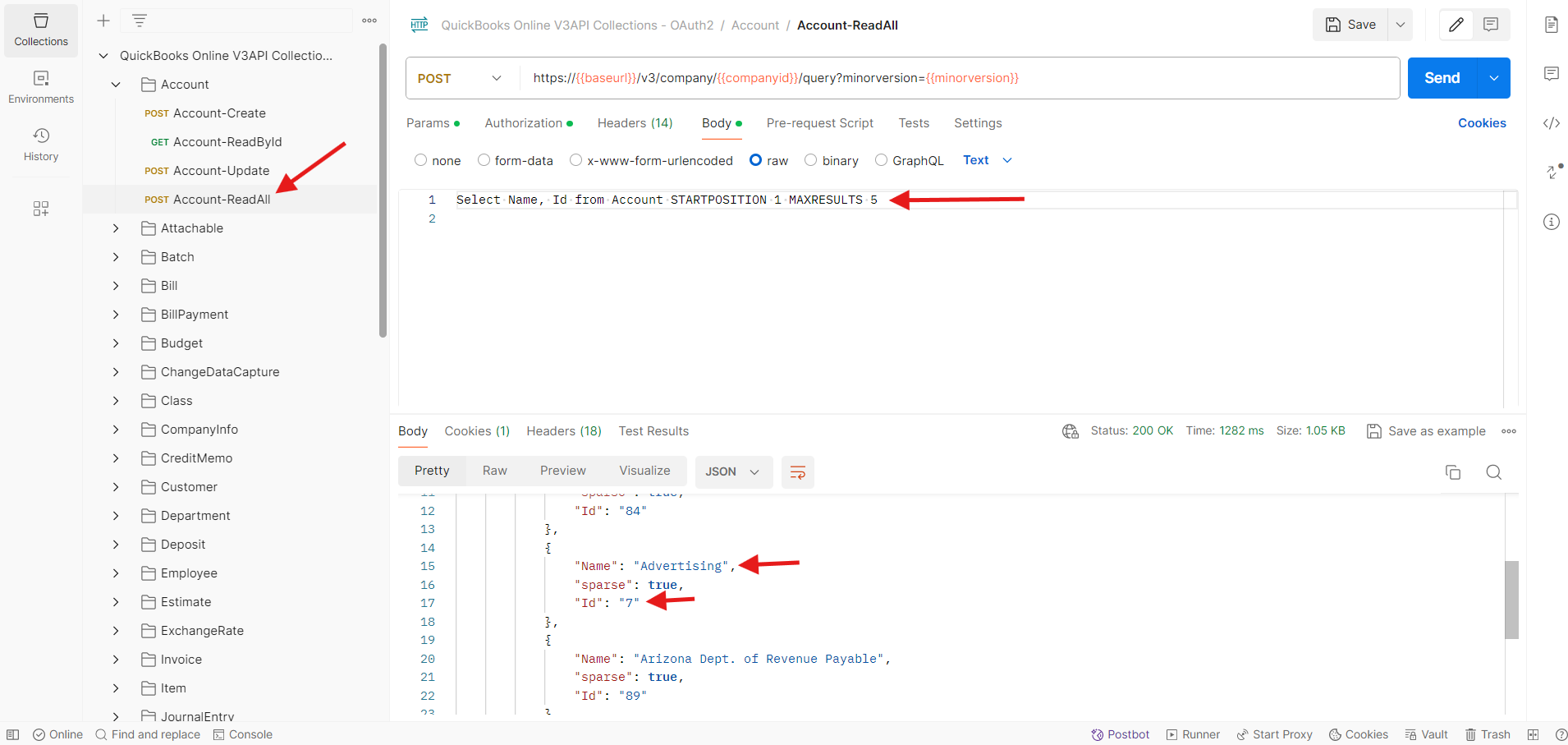

We need to configure CategoryId for each lease Company. To do this we need to use Account - Read All Api from postman.

-

Once we run this Api and get the response. We'll get a list of categories with names and ids. For example in prod we'll get a category named Jurni Savi with an id value. This id will be used as category id for Jurni lease company.

-

If you are not able to find the category you are looking for try setting the start limit to 99 and max limit as 100 in the query. you can use aggregate functions like 'count' and conditions like 'where' to identify a category.

-

Now copy the id obtained and add it in firebase against the lease company. Document Path: /leasecompany/QJKgdjS4I02sEia4yTne/config/quickBooks and add the field is categoryId.

Configuring financeSupplierId for suppliers.

-

When a supplier is created successfully from DI Admin OR supplier is imported successfully into ViSN.

-

Then supplier will be created in QuickBooks

-

Upon successful creation of supplier in Quickbooks

financeSupplierIdwill be assigned to supplier in ViSN. -

This

financeSupplierIdwill be used for further actions with Quickbooks.

eg: Invoice exports To QuickBooks

Supplier Creation.

Suppliers will be created at the time of import or creation from DI Admin, Or suppliers can also be created manually in quick books. This will be taken care by the DI Admin team.

Status: Approved

Category: Protected

Authored By:

Vignesh Kanthimathinathan on May 31, 2024

Hadley on August 06, 2024

Revisions

06 August, 2024 - Added Details about financeSupplierId, VN-13435